Give the ultimate joyride.

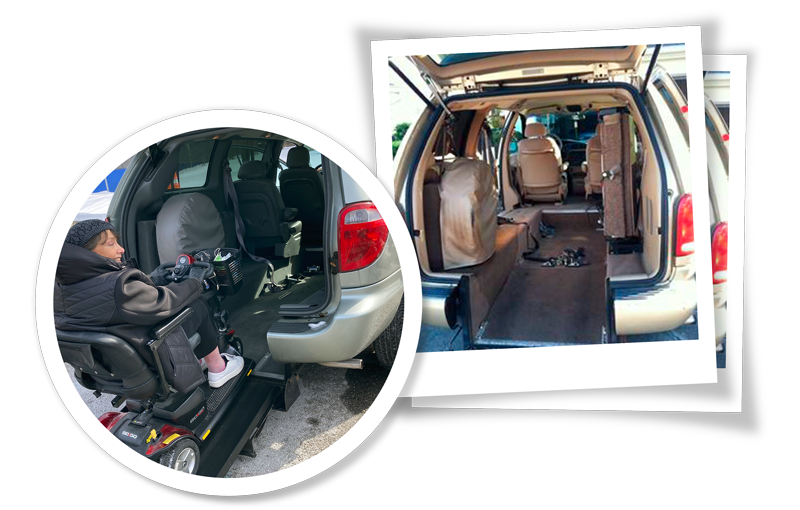

Donate your wheelchair-accessible van or a minivan in good condition that can be converted to those in need of one in your area. Ready to make a difference with your used wheelchair-accessible van or good condition minivan?

Sharing your van to benefit another family is a wonderful legacy.

Please let us know if you have a roadworthy handicap vehicle that is adapted for use by those with disabilities. We distribute to both children and adults in need. You will be eligible for a full ‘fair market value’ tax deduction. We help facilitate the family picking up the wheelchair van from your location.

You could receive a full tax deduction for the appraised value of your vehicle.

A Great Tax Deduction!

We will provide IRS paperwork and a limited liability form signed by the recipient. Vans are picked up by the family, from your residence.

Since the vehicles are not offered for sale, but are given to disabled clients, you are allowed a full ‘fair market value’ deduction. This is usually the best and highest figure for your tax deduction. Most other means of donating a vehicle will likely result in a lower figure for your itemized tax return.

Certified appraisals are required if you intend to claim over $5,000. Typically, your dealer will provide one. Your appraiser must also sign the IRS Form 8283 and forward it to us to co-sign. Please consult your own tax advisor for information and how the donation may affect your individual tax situation.

Our Proud Van Donation Partner

If you wish to donate a wheelchair van please fill out our van donation form below.

Give to Support

Sharing your van to benefit another family is a wonderful legacy.

Please let us know if you have a roadworthy handicap vehicle that is adapted for use by those with disabilities. We distribute to both children and adults in need. You will be eligible for a full ‘fair market value’ tax deduction. We help facilitate the family picking up the wheelchair van from your location.

You could receive a full tax deduction for the appraised value of your vehicle.

A Great Tax Deduction!

We will provide IRS paperwork and a limited liability form signed by the recipient. Vans are picked up by the family, from your residence.

Since the vehicles are not offered for sale, but are given to disabled clients, you are allowed a full ‘fair market value’ deduction. This is usually the best and highest figure for your tax deduction. Most other means of donating a vehicle will likely result in a lower figure for your itemized tax return.

Certified appraisals are required if you intend to claim over $5,000. Typically, your dealer will provide one. Your appraiser must also sign the IRS Form 8283 and forward it to us to co-sign. Please consult your own tax advisor for information and how the donation may affect your individual tax situation.

Our Proud Van Donation Partner

If you wish to donate a wheelchair van please fill out our van donation form below.